Why the Lifestyle Return Benchmark (LRB) matters

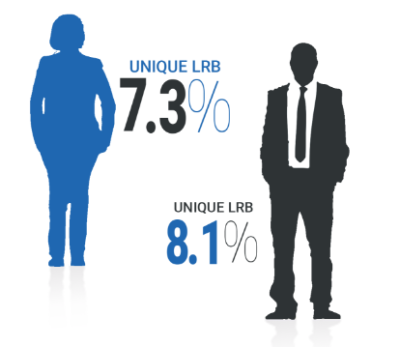

The lifestyle return benchmark establishes your customized rate of return benchmark, which is far more reliable than a random benchmark like the S&P 500, which is an unrelated measurement and has little bearing on your personal financial requirements.

We establish your LRB through our proprietary required rate of return (RRR) process. Each year we compare your LRB with your portfolio’s actual return to ensure you are headed in the right direction.

If your portfolio is off track, we adjust your plan and recommend ways to stay on course.